Welcome back!

This week, with the help of another one of my classmates, James Dunseth, we took a deep dive into the potential upcoming recession, and how it may play out in the crypto world. If you’re not big on macroeconomics or geopolitics, this newsletter may not be for you. However, this could be one of the next, biggest economic trends to impact crypto.

I hope you enjoy and see you next Sunday.

-Katja

How a recession may impact crypto

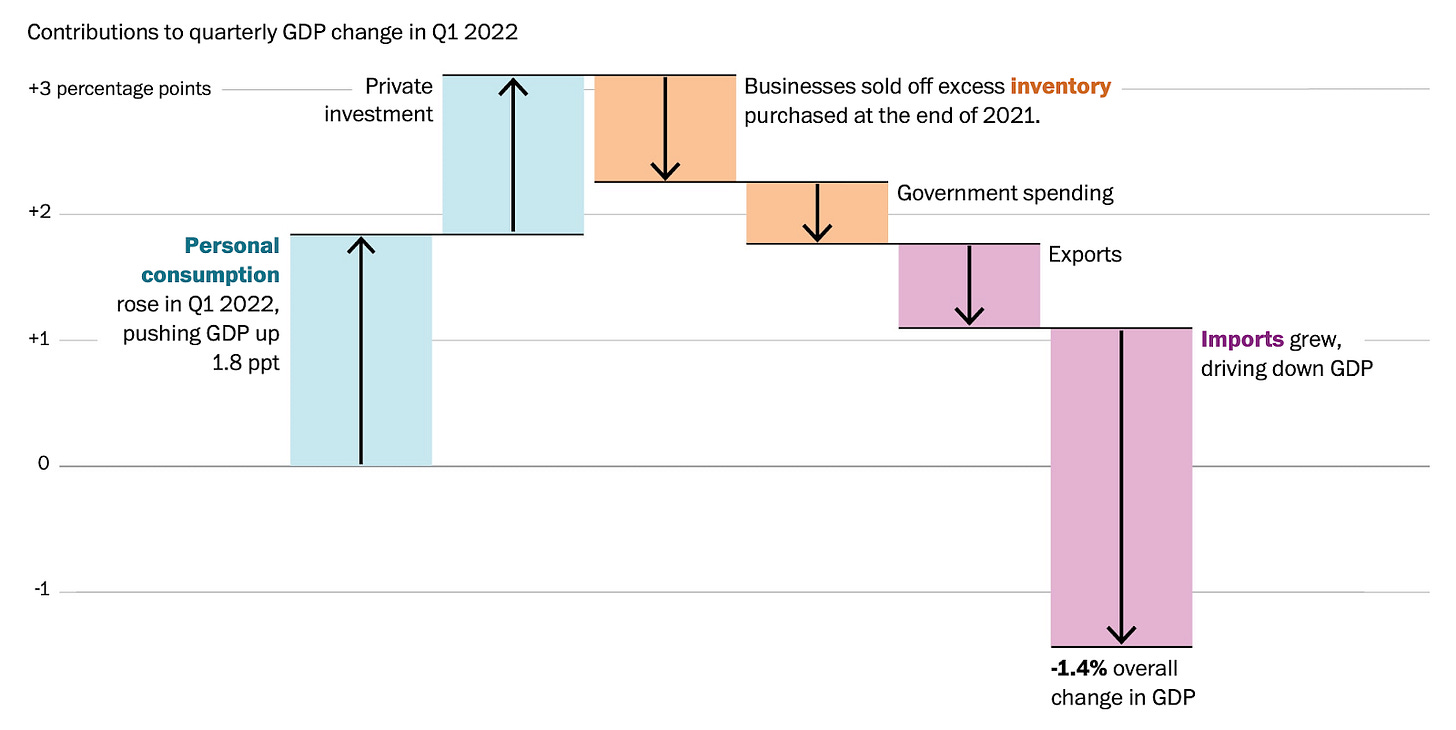

You may have seen, or at least heard, about the recent GDP numbers. In the first quarter of 2022, the US economy (GDP) shrank by 1.4%: the worst showing since the pandemic-induced recession of 2020. This news paired with record high (and rising!) inflation as well as broader geopolitical issues should set off some sirens, especially within talks of a potential recession.

However, not everyone is viewing this in a negative light. As Bill Adams, chief economist for Comerica Bank, told Fortune,

“The first quarter was not as bad as it looks at first glance … Despite a decline in real GDP, it wasn’t a recessionary quarter: GDP fell and was much weaker than expected, but consumer spending growth was solid and fixed investment growth robust.”

Just like Adams, others attribute the contraction to technical as opposed to fundamental reasons. To understand these technical arguments, let's take a look at what goes into GDP (using the expenditure approach for the econ-lovers out there):

GDP = Consumption + Investment + Government + Net Exports

Consumption. Consumer and business spending increased, which offers a positive sign for the economy (especially in the face of growing inflation and supply chain issues). Consumer spending maintained momentum despite rising prices, partially driven by rising nominal income as a result of a tight labor market, with many consumers saving less of their income. This may change if consumers change their spending habits as they feel more of the impact of higher prices.

Investment. Inventory fell due to businesses’ drop-off in securing excess inventory, which mainly came from decreases in wholesale and retail trade, while private-sector investment remained strong. Moreover, rising interest rates have dampened the real estate market, which has been seen in the recent decrease in mortgage applications.

Government. Although the year started with a wave of covid cases and subsequent business disruptions, government spending decreased due to the pullback of covid stimulus programs (like forgivable loans to businesses, grants to state and local governments, and social benefits to households). In addition to this, the government spending associated with the Infrastructure Bill hasn’t kicked in yet.

Net exports. The largest factor contributing to the decline in GDP came from a surge in imports (and trade deficit) driven by retailers scrambling to meet consumer demand and a drop in exports due to slowing economies among trade partners.

To help visualize the decrease in GDP, here is a chart from the Washington Post

The justifications behind the slowing economy do have some merit, but they seem to ignore rising inflation and larger geopolitical issues that affect the US and global economies.

I talked about rising inflation before, but will offer a brief recap here. During the pandemic, the government wanted to stimulate the economy to prevent the US from entering a recession. To do so, the government employed a set of fiscal policies in conjunction with the Fed’s monetary policies to encourage spending and consumption.

While focusing on promoting economic growth, the US largely ignored inflation. Now, the Fed is scrambling to fight this rising inflation by rapidly increasing interest rates. In most other cases, such monetary policy may be effective. However, current inflation may come from factors outside the Fed’s control: energy costs (Russia and the war on Ukraine) and supply chain issues (China’s covid lockdowns).

Putin recently declared that foreign buyers must pay in rubles for Russian gas in order to boost the country’s currency and sovereignty. Such a move was seen as a breach of contract (which is set in euros not rubles) by Western companies and governments.

Russia accounts for almost 30% of Europe’s imports of crude oil, 40% of its imports of natural gas, and 50% of its imports of solid fossil fuel. If these countries choose to not comply with Russia’s demands, Europe could be forced into adopting a gas rationing program, requiring businesses and individuals to compete for energy resources. Rationing gas could lead to even higher energy prices, job and income loss, and decreased consumption, sending Europe into a recession.

In the background, China is reinstituting strict pandemic lockdowns. The full effect of these new policies on China’s economy is difficult to tell; however, Bloomberg reported,

“Trade data on Monday will provide clues to the extent of the damage. Chinese export growth likely slowed to its weakest pace since June 2020, while imports probably contracted for a second month, a sign of weak consumer spending as millions of residents in Shanghai and elsewhere were confined to their homes.”

Further lockdowns coupled with supply chain issues in China will likely push China towards a recession, inducing additional pressure on the U.S. economy as net exports to China decrease with slowed Chinese spending.

Taking Russia and China together, their actions will further worsen the trade balance and push prices up (especially for gas), which could further force the US into a period of low growth and high inflation, otherwise known as stagflation.

The higher inflation, the more the Fed will raise rates, and the more the economy will slow. Understanding this, people may begin to expect a recession, which would decrease consumption, lower GDP, and increase inflation further … basically, an economic disaster.

It seems like the question isn’t if there will be a recession but when it will occur and how severe it will be.

How does all this relate to crypto?

As I’ve said time and time again, broader macro issues have a direct effect on the industry. It is important to understand how the potential recession may develop to have a firmer grasp on the timeline that could play out. These factors will not only cause volatility but a recession could bring about a massive upheaval, similar to the crash in 2021 that wiped out $1 trillion in value.

However, Chris Kline, co-founder and COO of Bitcoin IRA, pointed out to Protocol …

“This sell-off is not the same as others … Unlike past rallies that were primarily retail, the inclusion of larger institutions can affect price moves differently. ... This is uncharted territory for crypto as we enter a new phase in its lifecycle with attraction from big players, hedge funds and even governments signaling that they are open to this asset class.”

The potential recession will be accompanied by large levels of inflation, decreasing the purchasing power of money. In the crypto world, different currencies have built in mechanisms to make the assets inflationary or deflationary. For example, Bitcoin’s supply is capped at 21 million. I’ve discussed this idea before, but crypto (Bitcoin specifically) may become a safe-haven in such times when people need cash-alternatives that will preserve their value over time.

To further reinforce this idea, many institutions alongside (bullish) individuals have invested in Bitcoin over the past year. This wide-scale, rapid adoption has increased the chances that Bitcoin will hold its value over the long-term, despite enduring volatility in the short-term.

During a recession, this volatility and depressed price action can last for an extended period of time, sending crypto into a “crypto winter.” Although daunting, Vitalik Buterin, creator of Ethereum, said he welcomes such a period for the industry.

He justified this by saying how crypto price spikes bring many speculators who are in it for short-term gains. He went on to explain …

“The winters are the time when a lot of those applications [like NEM and NEO] fall away and you can see which projects are actually long-term sustainable, like both in their models and in their teams and their people.”

Such a crypto winter is needed in an industry that is becoming oversaturated with projects, especially those that offer no unique value proposition to users or developers. This may sound like a nice concept, but it will come at the expense of millions (if not trillions) of dollars lost with high price fluctuations for an unknown period of time.

Although crypto will not have an easy time during the recession, it will once again have a chance to showcase its resilience.