Crypto regulation in the US: Using 2021 to look ahead

The legislative landscape that will influence the new year

Welcome to the first Crypto Monkey Blog newsletter!

Since you signed up for the first newsletter, you probably know who I am (hi mom and dad); however, I’ll still introduce myself. My name is Katja, and I got interested in crypto several months ago when my brother sent me an article about an NFT project. While reading it, I had to continually look up different things, like “what the hell’s an NFT.” Three hours later, I was deep in the black hole of crypto.

Since that day, my interest has only escalated, and CMB was born.

I’ve decided to start writing about crypto to organize my own thoughts, as I dive deeper into the industry. In doing so, I realized that others may also benefit from what I write; therefore, if you’re a big crypto nerd already, this newsletter is probably not for you.

CMB will primarily focus on the intersection of crypto, politics, and business (at least for now). Some articles will be op-eds, while others, like the one for this week, will be more research-intensive.

I hope you enjoy reading these articles as much as I enjoy writing them.

See you next Friday.

-Katja

Crypto Regulation in the US: Using 2021 to Look Ahead

2021 - What an incredible year for cryptocurrency: from Bitcoin hitting an all-time high and becoming a legal tender of El Salvador to the meme-coin revolution to the rise of NFTs. It was also the year of people giving crypto a second look (a big welcome to me entering the crypto coalition).

The US government also started to see crypto in a new light. Throughout 2021, Congress introduced 35 bills pertaining to cryptocurrency that deal with (1) regulation, (2) applications of blockchain technology, and (3) central bank digital currency. There are many things to unpack, so this paper will focus on just one: crypto regulation.

Before jumping into the legislation, let's first consider the debate around regulating cryptocurrencies. The main points argued by those on the pro-regulation side include: increase investor protections, prevent money laundering and tax evasion, and solidify the US position in the global economy. On the other hand, those on the “anti”-regulation side claim that regulation would suppress the decentralized spirit of crypto, damage innovation, drive down crypto prices, and push the crypto industry out of the States.

This debate tends to come down not to whether we need regulation but to what is the correct level of regulation?

Crypto trends of 2021

Last year started with a crypto market cap of around $930 billion and finished around $2.75 trillion, with an all-time high of just over $3 trillion (in early November). Over a single year, the crypto market value increased by almost 200% and continues to grow at an exponential pace.

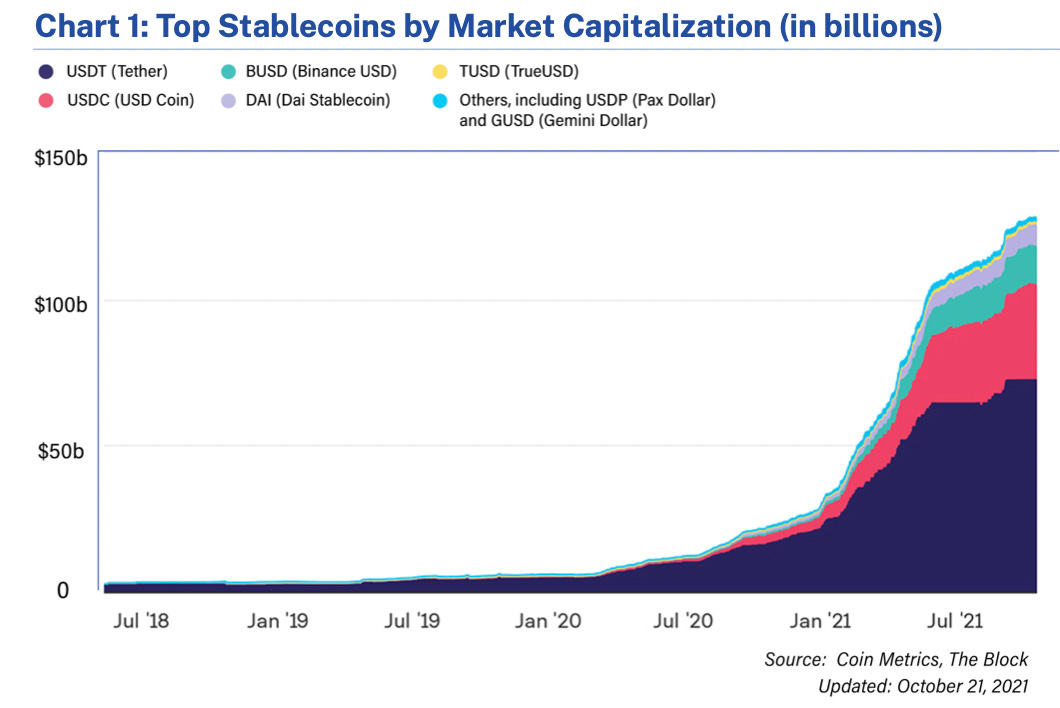

As crypto grows, the United States solidifies itself as one of the top 10 users of cryptocurrency. Because of this, the market caps of US dollar-backed stablecoins (crypto that’s tied to some fiat currency, making it more stable than traditional cryptocurrencies) have also skyrocketed, increasing by nearly 500% over the course of 2021.

This astronomical growth along with China’s forceful crypto crackdown have convinced American politicians to take cryptocurrency seriously, which explains the increase in crypto-related bills in Congress during the past 12 months.

Regulation throughout 2021

Starting with everyone’s favorite: Infrastructure and Investment Jobs Act

We will begin the regulation discussion with the Infrastructure and Investment Jobs Act that became law on November 15th, 2021. This hefty, 1,000+ page piece of legislation covers everything from providing clean drinking water to ensuring high-speed internet to investing in passenger rail. Our focus will stay on Section 80603, “Information reporting for brokers and digital assets.” That section outlines two amendments to the Internal Revenue Code (IRC) that deals with federal tax laws.

The first of these amendments redefines “broker” to include “any person who is responsible for regularly providing any service effectuating transfers of digital assets on behalf of another person.” Essentially, this expands the definition of broker from traditional exchanges (e.g. Coinbase) that are already licensed and regulated at the state level to others like miners and software developers. These “brokers” would have to report the name and address of each “customer,” information they have no ability to access.

The second amendment requires anyone engaged in a business transaction of $10,000 or more in digital assets (expanded from just requiring this of cash) to report the transaction to the IRS or risk criminal charges. This means, if someone buys an NFT from you for over $10k and you do not submit a form to the IRS within 15 days, you may have to pay $25,000 or spend five years in prison.

Requiring those who use cash transfers to report such information allows the government to combat illegal activity, but the same requirements do not hold up with cryptocurrency transactions because of the inherent nature of the blockchain (decentralized network that crypto runs on).

A blockchain functions as a public ledger, meaning everyone has the ability to view full transaction histories. The government can access it or hire a third-party (like Chainalysis or Coin Metrics) to analyze the blockchain and trace specific transactions. This, alongside other tactics discussed in the following section, makes blockchain technology much more effective at fighting criminal activity as compared to traditional banking or cash transactions.

Therefore, these two amendments make it difficult to understand what Congress aims to achieve other than banning mining and excessive surveillance.

Such concerns led to multiple bills proposing to revoke parts of these amendments. Sen. Ted Cruz (R-TX) proposed a bill to repeal the provisions that impose new information reporting requirements with respect to digital asset transfers. Ranking Member Patrick McHenry (R-NC) alongside 12 bi-partisan co-sponsors introduced a bill to amend the definition of a broker. Rep. Darren Soto (D-FL) introduced two other bills to fix the language around crypto tax reporting.

Bills pertaining to ransomware and other illegal activities

Cryptocurrency does hold a certain allure for criminals because of its easy transactions and pseudonymous nature, but this appeal does not hold up in reality. The total crypto value of criminal activities totaled $10 billion in 2020. This may seem large but only accounts for 0.34% of all cryptocurrency transactions. To put this into a broader perspective, money laundering alone totals around 2-5% of the global GDP.

Illicit activity includes scams, Darknet markets, and ransomware, among others. Scams (i.e. when someone uses fraudulent information to get access to a victim’s digital wallet or to get a victim to transfer them crypto) made up over 50% of all crypto-related crime. The second largest category of crime was Darknet markets (basically a black market using crypto as payment). The third largest category of crime, ransomware (explained later), grew by 311% from the previous year, putting it at 7% of total criminal activity.

Unfortunately for criminals, using crypto for nefarious purposes does not get them very far. Blockchain technology provides an incredible paper trail. Law enforcement agencies have more resources and better tools for tracking and identifying criminals. US government officials are creating better infrastructure, like with Rep. Ted Budd’s (R-NC) bill to combat illicit financing by providing rewards for information related to illicit activities and establishing a task force to deal with such activity. Crypto exchanges have also started to develop their own system of identifying the bad actors.

One exception to these tactics is ransomware.

First, the definition: ransomware is a type of harmful program (malware) that shuts down your computer and steals data until you pay a sum of money (ransom). Attackers can trick their victim into downloading this malware through something like a phishing email. This type of crime significantly rose during the pandemic as employees had to adopt work-from-home measures (weaker IT systems) and were more prone to lures related to COVID-19.

Ransomware crime brings many complications. The malware steals sensitive data (like Social Security numbers), giving attackers more leverage (higher ransom payments). Because of this information leak, many companies don’t report the attacks they experienced to not bring clients’ attention to the exposure of their private information and risk reputational damage.

What should be done about this type of crime remains unclear. The government has considered requiring immediate disclosure of ransoms, banning all ransom payments, banning cryptocurrency, and banning certain exchanges or transactions, among other ideas.

Sen. Marco Rubio (R-FL), Dianne Feinstein (D-CA), and Roy Blunt (R-MO) introduced a bill to reduce anonymity of those suspected of ransomware activity, while Sen. Elizabeth Warren (D-MA) and Rep. Deborah Ross (D-NC) proposed bills to require individuals, especially ransomware victims, to provide any relevant information related to ransomware payments.

The inevitable question: are digital assets “securities”?

We cannot talk about this issue without first mentioning the 1946 case SEC vs W J Howey Co. In this case, the Supreme Court established the “Howey Test” for assessing if something is an investment contract and (therefore) a security subject to specific disclosure and registration requirements. As it pertains to crypto, mixed applications of this test have produced mixed results.

If a cryptocurrency is considered a security, then only qualified custodians, as opposed to financial advisors, can hold them. These custodians have more cybersecurity and can protect assets through a centralized system. However, using custodians brings about two issues.

First, crypto came about to avoid this type of system through decentralization and self-custody of assets. (Otherwise, just use a bank.) Second, financial advisors will stay away from crypto, even if a client expresses an interest in it. This would effectively shrink the market by suppressing accessibility.

To deal with this issue, Reps. Tom Emmer (R-MN), Darren Soto (D-FL), and Ro Khanna (D-CA) introduced a bill to exclude investment contract assets from the definition of a security. Meanwhile, Rep. Warren Davidson (R-NC), alongside bi-partisan members of Congress, pushed a bill to exclude digital tokens from the definition of a security.

What this could mean for 2022

Last year marked the beginning of the conversation between the crypto world and the US government. As you can see from the brief overview of the legislation, a lot of work remains to be done.

Congress has already taken proactive steps to understand the crypto industry, like with the House hearing on digital assets. During that hearing, the six crypto executives testified that they want to see a clear system of regulating cryptocurrencies (similar to what the UAE has already done), and that they would be willing to work with the government in getting it done.

With the crypto industry ready to help, the US government now faces three options.

No regulation - It can choose to not regulate the market and lose the crypto race. Eventually, this would push the US to adopt the regulation policies of other countries, forfeiting the opportunity to set standards for crypto regulation and weakening America’s position in the global economy.

Bad regulation - It can choose to regulate crypto without fully understanding it. This would lead to bad legislation and an exodus of the crypto industry from the US, losing millions of potential tax dollars.

Overregulation - It can choose to overregulate crypto, pushing the industry out of the states and increasing illicit activity, as criminals employ better tactics to avoid law enforcement agencies and more “good actors” leaving the industry altogether.

What the US chooses to do matters, so members of Congress started to prepare for the year. Sen. Cynthia Lummis (R-WY) already announced that she will propose the most comprehensive bill on cryptocurrency, covering everything from categorizing crypto to taxation policies to consumer protections.

With the rapid developments happening in the crypto world, I would expect Congress to follow a similar pace, which the midterm elections will only reinforce.

2022 has an interesting path ahead, as the US government continues to work on its relationship with crypto. I am excited to see how everything will unfold, and I look forward to writing about it and the developments that follow.

Footnote: This paper relied heavily on the work of TBI in his annual crypto report, Jason Brett in his Forbes article, and the Chainalysis team in their annual crypto crime report. Thank you all for putting in the time, so I can save some of my own. Keep it up.